These whales control the entire decentralized exchange (DEX) market…

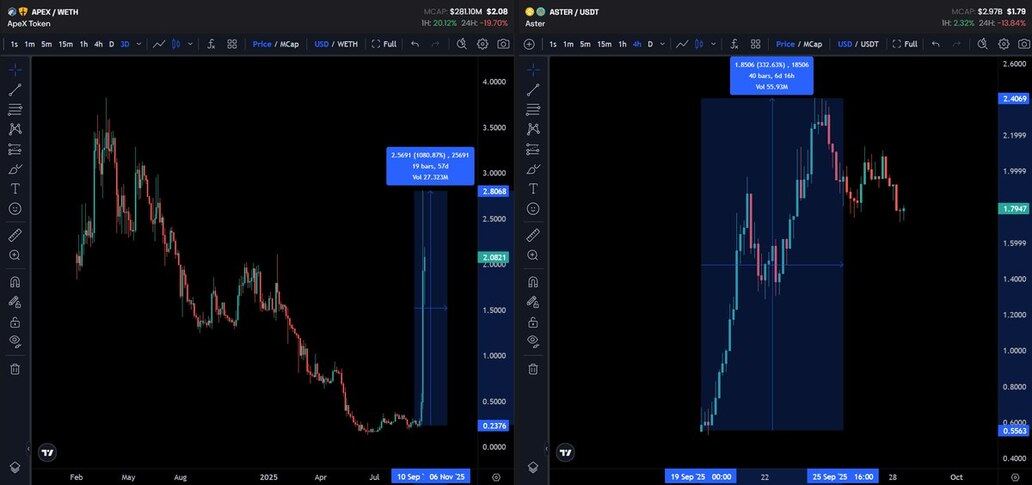

They pumped $ASTER (391x), $APEX (214x)

Now, they are accumulating new altcoins before the pump…

Here are their wallet addresses, along with 5 low market cap DEX tokens that will be pumped 500x next👇🧵

#空投 #空投教程 #空投線程 #Airdrop #土狗 #meme

Have you noticed how quickly the hype around DEX has started?

We are actually witnessing a war between teams.

- $ASTER - up 25 times in 4 days

- $APEX - up 10 times in 1 hour

This is a huge boost for cryptocurrency, but behind all this, it's the same operational tactics.

The gameplay of $ASTER is very clear

- Only 4% of the circulation remains

- It's very easy to pump the token

- It's very easy to control everything

All the supply is concentrated in the wallets of 6 founders

Is this a bad thing? - As we can see, it is not currently in this market.

So, what situation do we currently have?

- Various teams are desperately chasing the hype of DEX

- Every blockchain wants a piece of the liquidity pie

- This is a perfect money-making opportunity for us

We just need to track those smart wallets that know more than we do

Just like these wallets based on $ASTER and $APEX:

Wallet address: 0xe8c3e6559513eebac3e05fd75c19a17f4a51a892

Holdings:

- 61.3 million $ASTER = approximately 100 million USD

A completely unknown wallet holding a large amount of the $ASTER supply

Moreover, this is not a liquidity pool

Wallet address: 0xb88f3bc2ad32d3d256e26347d1ad24332a18185d

Holdings:

- 413,000 $APEX = approximately $1 million

This wallet has been driving up the token price

It conducts a large number of operations through pool manipulation and buybacks, and this wallet is part of that.

So, our main task right now is to track DEX across chains and think ahead.

By deeply researching on-chain information, you will definitely find direction.

My own analysis shows that whales like this are focusing on just a few assets.

@satlayer | $SLAY | Market Cap: $12.8 million

A perfect protocol for $BTC re-staking in the current metaverse

Would a project based on the #1 asset perform poorly?

Just a few announcements can replicate the $APEX model

Contract Address - 0x51477A3002ee04B7542aDfe63ccdb50c00Ee5147

@concordiumnet | $CCD | Market Cap: $239.86 million

A Layer 1 blockchain focused on regulatory compliance and enterprise applications.

It had been quiet for a while, but now it is starting to show performance.

The current background and trends are helpful for growth, but the risks here are also high - please do your own research.

@oasyschain | $OAS | Market Cap: $44.38 million

A Layer 1 blockchain fully tailored for GameFi and Web3 gaming.

Yes, this isn't the hottest trend, but liquidity is slowly shifting here.

GameFi can easily pump, and this project can perform well thanks to its technology.

@defidotapp | $HOME | Market Cap: $82.91 million

An outstanding project during the current boom in decentralized finance (DeFi), making access easier

A convenient platform with all the key integrations

A good choice in this market trend

Contract Address - 0x4bfaa776991e85e5f8b1255461cbbd216cfc714f

@awenetwork_ai | $AWE | Market Cap: $211.2 million

A blockchain project focused on building scalable virtual world infrastructure.

The concept is interesting, and the technology is already driving growth.

Worth keeping an eye on, and worth a small investment.

Contract Address - 0x1B4617734C43F6159F3a70b7E06d883647512778

14.54K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.