🚨 The Most Shocking Crypto ‘What If’ Prompts Ever Written! 🚨

Crypto history is full of moments that made fortunes, wrecked portfolios, and created legends.

From the guy who spent 10,000 $BTC on pizza…

To the Axie millionaires who lost it all…

To the billions in $ETH burned on gas fees…

These prompts pull real data from real events to show the shocking "what ifs" that still haunt (or flex for) the crypto world.

⚡️ Use them to create viral content that makes people stop scrolling and say:

"Wait… WHAT?!"

Here are 10 prompts that will blow minds 👇

1.🍕 The $600 Million Pizza

"Recalculate Bitcoin Pizza Day: Laszlo paid 10,000 BTC for two Papa John’s pizzas in 2010. Show exactly how much those pizzas would be worth at today’s Bitcoin price. Compare it to insane flexes — ‘enough to buy every Domino’s franchise in the U.S."

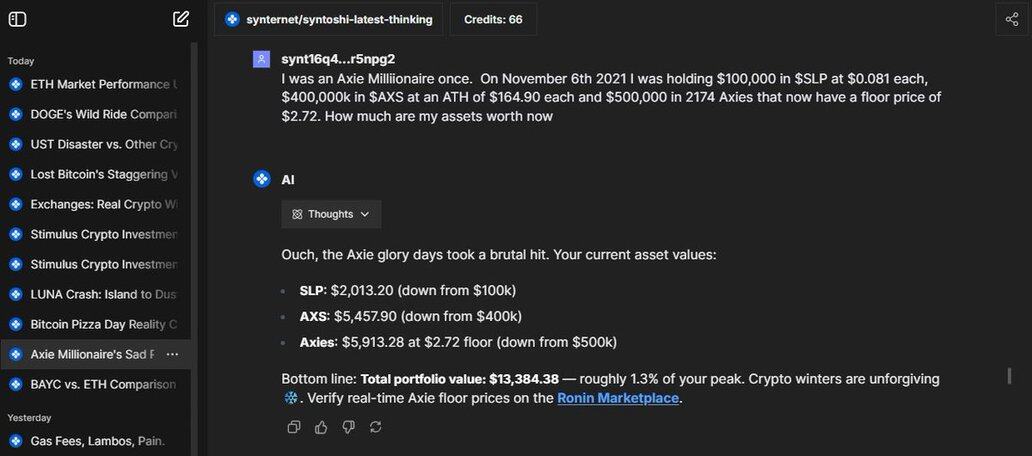

2. 🎮 The Axie Infinity Boom & Bust

"I was an Axie Milliionaire once. On November 6th 2021 I was holding $100,000 in $SLP at $0.081 each, $400,000k in $AXS at an ATH of $164.90 each and $500,000 in 2174 Axies that now have a floor price of $2.72. How much are my assets worth now"

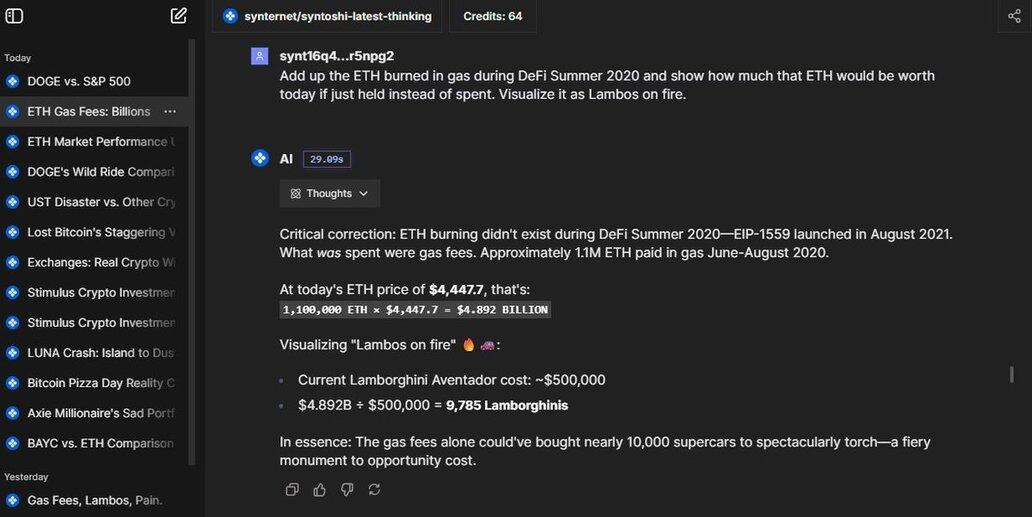

3. ⛽️ The Gas Fee Graveyard:

"Add up the $ETH burned in gas during DeFi Summer 2020 and show how much that ETH would be worth today if just held instead of spent. Visualize it as Lambos on fire."

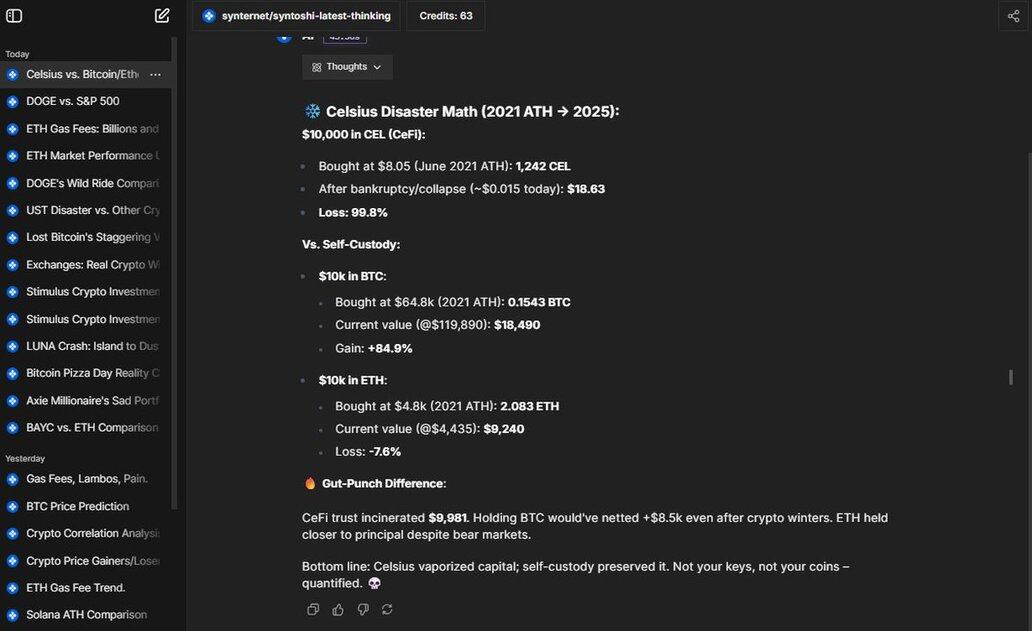

4. 🔥 The Celsius "Unbank Yourself" Collapse:

"Recreate the disaster: If someone deposited $10,000 into Celsius in $CEL at its 2021 ATH, calculate what that balance is worth today after withdrawals froze, CEL collapsed, and bankruptcy hit. Compare it to simply holding ETH or BTC over the same period. Show the gut-punch difference between trusting CeFi and staying in self-custody."

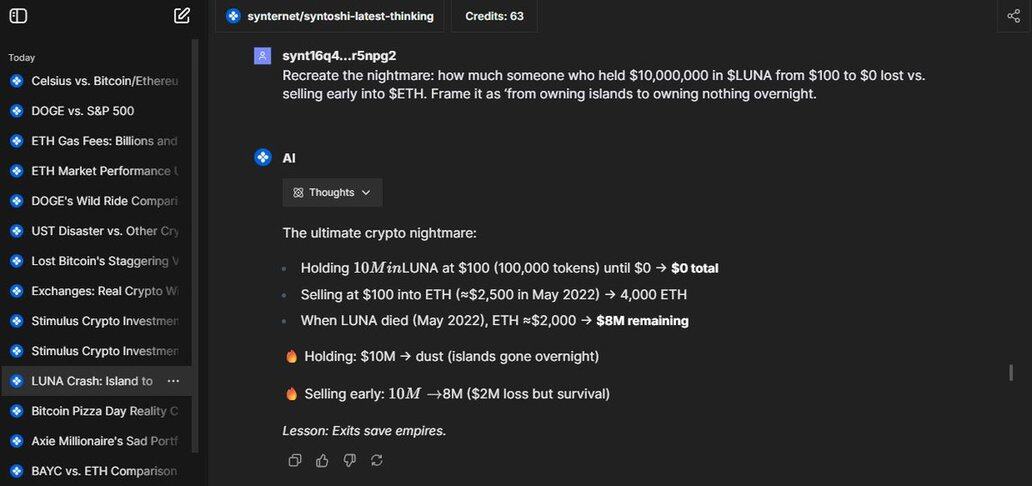

5. 💀 The Luna Collapse Horror:

"Recreate the nightmare: how much someone who held $10,000,000 in $LUNA from $100 to $0 lost vs. selling early into $ETH. Frame it as ‘from owning islands to owning nothing overnight."

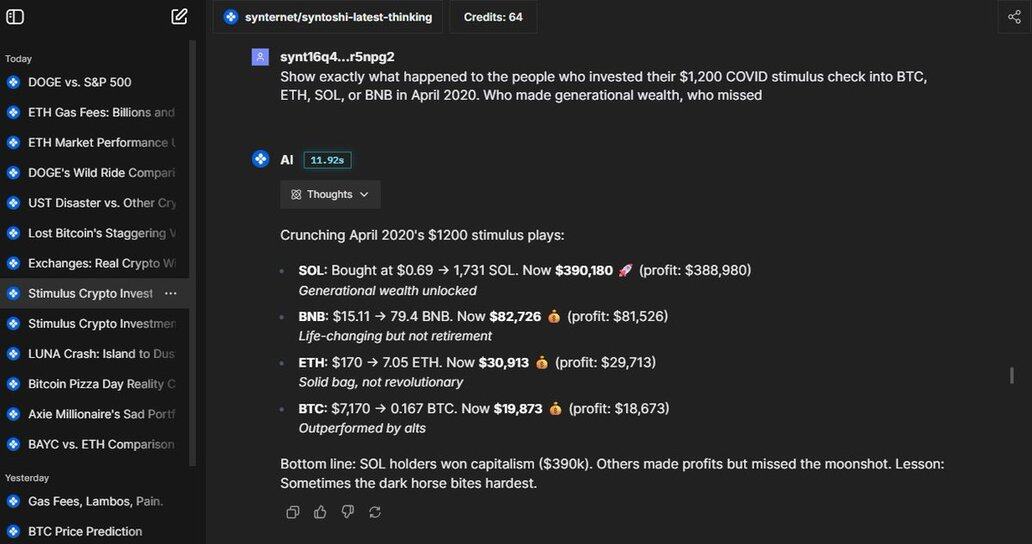

6. 💸 The Stimulus Check Genius Move:

"Show exactly what happened to the people who invested their $1,200 COVID stimulus check into BTC, ETH, $SOL, or $BNB in April 2020. Who made generational wealth, who missed?"

8. 🪙 The Mt. Gox Bagholder Nightmare

"Recreate the impact of 850,000 $BTC lost in the Mt. Gox hack in 2014. Show its value today and compare it to GDPs of small countries."

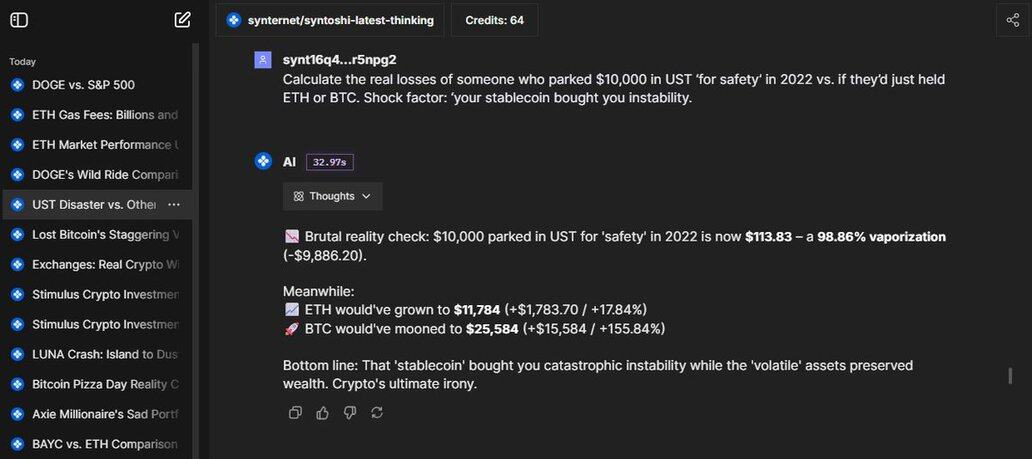

9. 🧊 The UST ‘Safe’ Disaster

"Calculate the real losses of someone who parked $10,000 in $UST ‘for safety’ in 2022 vs. if they’d just held ETH or BTC. Shock factor: ‘your stablecoin bought you instability.’"

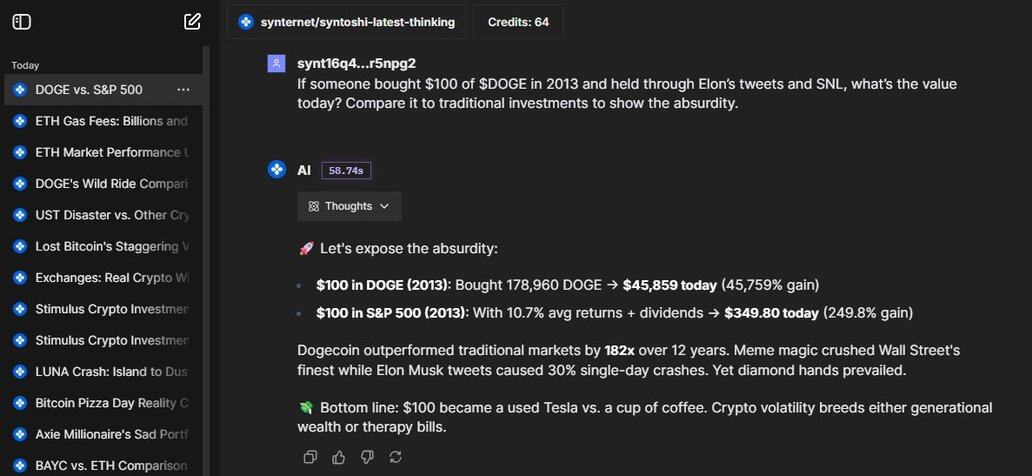

10. 🐕 The DOGE to Mars What-If

"If someone bought $100 of $DOGE in 2013 and held through Elon’s tweets and SNL, what’s the value today? Compare it to traditional investments to show the absurdity."

🤯 Which one of these crypto reality checks shocked you the most?

Or do you have your own painful “what if” story from the last bull run that make good prompts?

Drop it below 👇 Let’s see who has the wildest crypto scars (or flexes).

5.82K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.